Famous Hackers with the handle DigitalBoysUG have hacked the Hana Bank of Korea website (http://www.hanabank.com/) under Anonymous flag and named the operation #Operation Korea. Hackers leaked Staff Credentials online.

The hackers announced the hack and leaked information on twitter handle and posted the leaked credentials on pastebin.

Targeted Site:

http://www.hanabank.com

Leaked Information:

http://pastebin.com/saHd7Uuk

The leaked information of 124 staff accounts details contains staff email addresses, encrypted MD5 hashed passwords and credit card numbers. The document also contains some secret internal instructions and information.

Some leaked information by the hacker that is posted online.

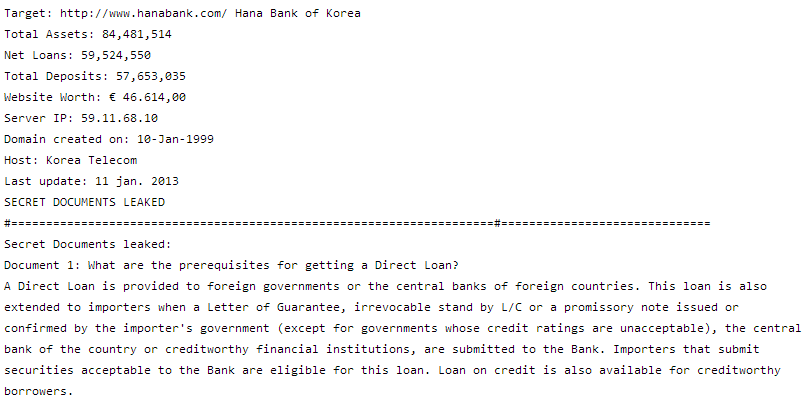

Secret Documents leaked:

Document 1: What are the prerequisites for getting a Direct Loan?

A Direct Loan is provided to foreign governments or the central banks of foreign countries. This loan is also extended to importers when a Letter of Guarantee, irrevocable stand by L/C or a promissory note issued or confirmed by the importer’s government (except for governments whose credit ratings are unacceptable), the central bank of the country or creditworthy financial institutions, are submitted to the Bank. Importers that submit securities acceptable to the Bank are eligible for this loan. Loan on credit is also available for creditworthy borrowers.

#=====================================================================#==============================

Document 2: Does the Bank have any recourse to exporters in case importers become insolvent?

No, the Bank does not have any recourse to exporters even when importers go bankrupt during the loan period. By entering a loan agreement with an importer, the Bank takes all the credit risks of the importer.

#=====================================================================#==============================

What is the difference between Project Finance and a Direct Loan?

A Direct Loan is usually secured by a Letter of Guarantee, irrevocable stand by L/C or a promissory note issued or confirmed by the importer’s government, the central bank of the country or creditworthy financial institutions, while repayment of loan extended under Project Finance mainly relies on the project cash flow. As a result, reviewing loan applications for Direct Loans mainly focuses on the creditworthiness of the borrower or the guarantor, whereas for Project Finance, the feasibility, risk analysis of the project and the contents of related contracts are the main focus of the review.

#=====================================================================#==============================

Are feasible and promising projects always eligible for Project Finance?

No, not necessarily. In the case of Project Finance, since the loan repayment relies on the project cash flow, the related agreements should clearly contain wordings that keep the project from various possible risks, not to mention the necessity of economic feasibility to be eligible for this type of financing. The creditworthiness of the parties (EPC contractor, off-taker, feedstock supplier, etc.) is another important factor to be examined.

Complete message and leaked information can be found here.